Thank You for your interest in SCPDC Corona Recovery Loans.

PLEASE READ BEFORE APPLYING. INCLUDED IS GUIDANCE ON HOW TO USE THE ONLINE APPLICATION AND MAKE THIS PROCESS AS EFFICIENT AS POSSIBLE.

We are working to assist our Regional small businesses as we lead up to greater recovery efforts as the COVID 19 disaster progresses. Offering this bridge loan is a small step in what will hopefully become a large-scale response as we anticipate working with our State and Federal partners to participate in future comprehensive recovery funding related to small business loans. Please note that we are using our existing loan funds (which are somewhat limited) to offer these loans, and we do not have the financial backing of the Federal Government. These loans are not associated with SBA and are NOT forgivable, and we are unsure as to how this may trigger duplication of benefits related to SBA loans. They are meant to be a “bridge” to get you to the next phase of funding.

The following ELIGIBILITY items must be met:

- Business located in eligible Louisiana parish (see list below)

- In business 3 years evidenced by tax filings

- No more than 30 employees

- 600 minimum credit score

- $25,000 average annual gross revenue over the last 3 years

- Occupational license (or equivalent)

- Completed application and supporting documentation (listed above)

- Other analysis and underwriting to take place internally

Terms:

- $20,000 lump sum

- 6 months deferral

- 5 year amortization

- 0% interest years 1-2, 4% interest years 3-5

- Use of funds: working capital

A completed application must include the following (to be uploaded with the application – WHERE THE APPLICATION MAY DIFFER FROM THIS LIST, USE THIS LIST AS THE RULE):

- Online application (SEE additional guidance below)

- Current parish occupational license

- Most recent 3 years business taxes

- YTD P&L (and 2019 if you haven’t filed taxes yet)

- Proof of ownership structure

- Statement of understanding form

- Business debt schedule

- For each owner 20% or more:

- Most recent 3 years personal taxes

- Credit authorization form

- Individual profile form

- Personal financial statement (form or you may use your own)

- Copy of government ID

Many of the fields in the application are not required. Only the fields that contain asterisks (*) must be completed. Feel free to skip over non-required fields or entire sections that don’t apply to this loan request.

If you have the capability, you can use an electronic signature for most of these documents EXCEPT the Statement of Understanding and the Credit Authorization(s). These MUST be filled out, printed, hand-signed, scanned, and then uploaded.

The first part of the application requires a “business narrative”. For the purposes of this program, we are accepting a brief summary of your operations to include history, products/services offered, etc.

All supporting documentation can be uploaded with the application or emailed to businessloans@scpdc.org. Questions and support assistance available through the business loans email or by calling 985.655.1051 x4000.

SCPDC Corona Recovery Loan APPLICATION can be found at https://cloud.bmisw.com/SCPDC/Workflow/Enter/Begin.

We thank you so very much for your interest in our programs and in our organization, and we ask that you please remain patient with us, as we are navigating some new internal processes as we reach out to assist yours and other small businesses in our region. Blessings to you, your families, and your businesses as we all come together to defeat this silent enemy and bring our economy back to the thriving market we’ve been experiencing over the last few years. Please contact me with any concerns or questions you may have. We look forward to assisting you!

Lisa Maloz

Loan & Grant Analyst

985-665-1051 ext. 2075

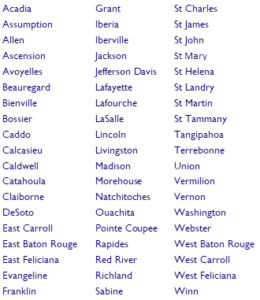

Businesses located in the following Louisiana parishes are ELIGIBLE:

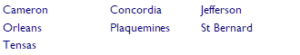

Businesses located in the following Louisiana parishes are INELIGIBLE: