Financing for small businesses isn’t always easy to obtain. Traditional financing resources may find it difficult to meet individual business development needs. The Bayou-River Region Loan Program is a finance program operated by SCPDC and is specifically created to fill the gaps in financing not provided by conventional means such as direct loans or those initiated by local banks. The program offers a fixed rate that is substantially lower than available commercial rates.

Our staff can help businesses identify other appropriate federal, state and local financing programs to help meet their financing needs. We also offer referrals to rapidly expanding networks of management, product, and process development, and marketing assistance resources.

If you or one of your customers is an established business with plans to expand operations, our loan program may be able to offer solutions to the business financing challenges.

Our Commitment

- To assist existing businesses wishing to expand operations.

- To aid businesses wishing to locate in one of the participating parishes.

- To connect eligible businesses with comprehensive financing packages.

Our purpose is to assist in the retention and creation of jobs, as well as strengthen and diversify the local economy. The low interest rate and less stringent debt ratio provide us the flexibility to assist small business and accomplish these goals.

Types of Businesses

- For-profit; Non-profit

- A corporation, partnership, or sole proprietorship

- Located in one of the participating parishes

- Existing businesses (new businesses being started by proven entrepreneurs with job creation potential MAY)

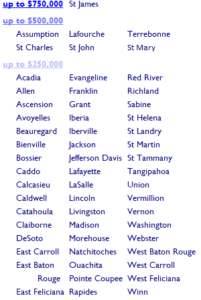

Eligible Areas

Loans are available to:

- Purchase, repair or modernize machinery or equipment

- Working capital for specifically defined purposes (inventory, insurance, etc.)

- Professional fees—legal, title search, title insurance, appraisal, accounting, etc.

- Purchase of Real Property

- Small scale construction or renovation (support structures, manufactured or metal buildings, docks, sheds. etc.)

Ineligible use of funds:

- New construction of buildings (exceptions can be made for small scale support structures, manufactured or metal buildings, docks, sheds, etc.)

- Gaming Operations

- Financial institutions or other re-lending purposes

- Refinancing of state Bridge Loans

- Payment of tax arrearages, government fines/penalties

- Political or religious activities

- Buying out any stockholder or equity holder in business

- Buying out or reimbursing any family member

- Intangibles

Financial Information/Bank Initiating Loan Requirements

- Application including detailed list of Source and Use of loan proceeds equaling the total project

- Bank Denial Letter (denial may be for total or partial loan request)

- Comprehensive Business Plan including at least three years of revenue and expense projections

- Financial Documentation—Business and Personal including:

- Current Personal Financial Statements from principle* owners and key managers* (not over 60 days old)

- Current Business Balance Sheet and Income Statements (not over 60 days old)

- 3-years Business Year-End Financial Statements and Tax Returns

- 3-years Personal Tax Returns (all principal* owners and key managers*)

- Resumes of all principle* owners and key managers*

- $150 application fee

*refers to any proprietor, partner or stockholder with a 20% or more ownership interest in applicant company

For more information or to apply for a loan, please contact Lisa Maloz at 985.655.1051 x2075 or lisam@scpdc.org

20190409-SCPDCLoanProgramApplication